HMRC App: Empowering Taxpayers to Manage Their Own Tax Affairs

06 February 2025

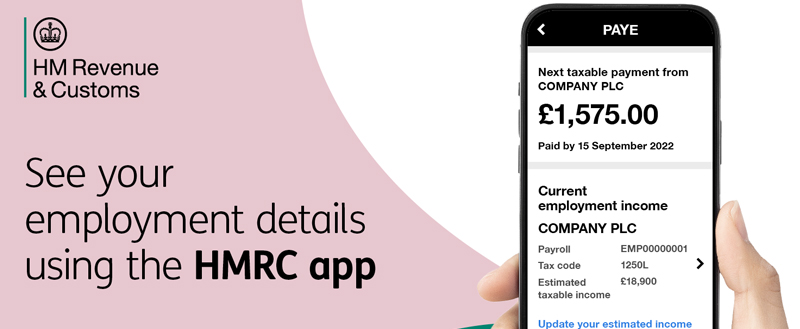

Many taxpayers contact us to check their tax accounts, but did you know that HMRC has created a free, easy-to-use app that allows individuals to manage their own tax affairs? The HMRC app is a convenient tool that provides instant access to key tax information, helping users stay on top of their finances without the need to call or wait for assistance.

What Can You Do with the HMRC App?

The HMRC app allows taxpayers to:

-

Check their tax code and income details – See what tax code HMRC has assigned and understand how their income is taxed.

-

View their tax refund status – If expecting a tax rebate, users can check progress directly through the app.

-

Track their self-assessment status – See deadlines, payments due, and manage tax returns.

-

Access National Insurance (NI) details – View NI contributions and understand eligibility for benefits and the State Pension.

-

Manage their Personal Tax Account – Update details, check tax credits, and more.

-

Make tax payments – Pay any outstanding tax bills securely.

-

Access important documents – Download tax calculation summaries, employment history, and other key records.

Why Should Taxpayers Use the HMRC App?

-

Saves time – No more waiting on hold or writing letters; everything is accessible instantly.

-

Available 24/7 – Check tax details whenever needed, even outside business hours.

-

Secure & easy to use – Log in quickly using a Government Gateway account and securely access tax records.

-

Reduces errors – By viewing their own information, taxpayers can identify mistakes and update HMRC directly.

With so many taxpayers still asking us to check their details, be mindful that the HMRC app is designed to put you in control. Instead of relying on third parties, you can conveniently manage your tax information from your phone. Clients can download the HMRC app today and take charge of their tax affairs with ease!